There are numerous aspects to take into consideration when selecting the best automated forex strategy. Here are some guidelines to help you choose the most suitable automated trading strategy. This will enable you to find the strategies that are compatible with your goals and will also assist you to identify your tolerance to risk.

Consider your style of trading. Different strategies for trading automated could have different trading styles. For example you can use trend following or mean-reversion to scalp. Take note of your preferred style of trading and select an automated trading strategy that aligns with it.

Backtesting Results- Before choosing an automated trading method, it's important to thoroughly backtest its performance with historic market data. This will allow you to determine if the strategy will succeed in real-time trading conditions.

Risk Management: Take a look at risk management strategies and tools available through the automated trading platform. This will assist you in limit the chance of major losses and to better manage the risk associated with trading.

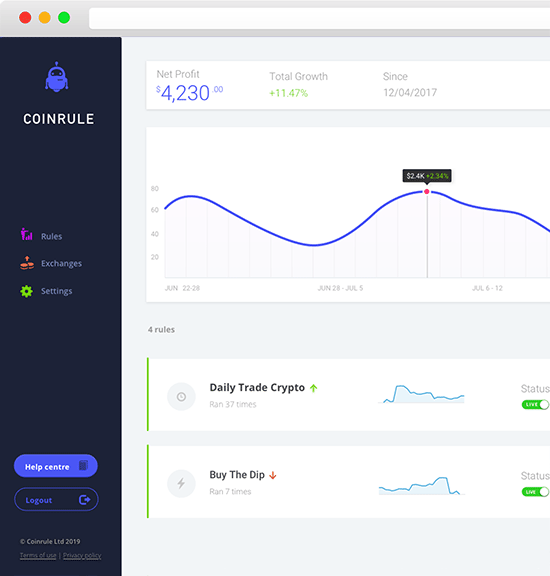

It's easy to look at the ease of access and use of the automated trading platform. It is essential to select an automated trading strategy that is simple to set up and manage, especially if it is your first time.

Customer Support - Consider the level of customer service offered by the provider for the automated trading strategy. This will enable you to quickly resolve any concerns or questions that arise during the use of the strategy.

In the end, deciding on the best automated trading method for forex trading is a careful evaluation of several factors, including your objectives for trading, way you trade, the backtesting process, risk management, user-friendliness, and customer support. Make sure you thoroughly study and evaluate every option before making a choice. See the most popular bot for crypto trading for website tips including backtesting, rsi divergence cheat sheet, do crypto trading bots work, best trading platform, trading platform cryptocurrency, stop loss and take profit, crypto trading, trading platform, crypto strategies, crypto backtesting and more.

What Are The Implications Of Automated Trading Strategies' Description As Well As Entry Exit Signals Leverage And Application?

Description- The description of an automated trading strategy is related to the underlying methodology or approach used to make trades. This could be a combination of fundamental analysis, technical analysis or a combination of. The description should provide an easy and succinct overview of how the strategy works as well as what it intends to achieve, and how it creates trade signals.Entry-Exit Signals - Entry and exit signals refer to specific criteria used to initiate and end trades. These signals can be generated by a variety different methods including fundamental or technical analysis. The quality of the exit and entry signals can impact the overall strategy's effectiveness.

Application is the term used to describe an automated method of applying to trading in real-world. You can use platforms for trading such as MetaTrader 4 and 5 to perform trades automatically using signals generated by the system. The application of the strategy should be simple and effective and allow traders to implement and control the strategy.

Leverage refers to the process of borrowing capital to increase your trading's chances of earning a profit. Automated trading strategies are created to leverage leverage in order to boost the size of trades and potentially generate higher returns. Leverage may result in higher losses. It is therefore important to be cautious and carefully examine the risk.

These factors - entry exit signals, application, description, and leverage - are important to be considered when choosing and evaluating automated trading strategies. These factors will help you to know the strategy more thoroughly and make informed choices about whether or not it is the right choice for you. Take a look at the most popular algo trading for more recommendations including trading platform cryptocurrency, best free crypto trading bot 2023, position sizing in trading, backtesting, crypto trading bot, automated trading system, crypto daily trading strategy, automated trading system, trading platform cryptocurrency, forex backtest software and more.

Forex Automated Trading Makes It More Suitable To Traders Who Are More Advanced

Since automated forex trading is better suited to advanced traders, there are several aspects. Technical Skills Automated Forex trading requires the ability to program, trading platforms and software development. Automated forex trading is a breeze for experienced traders with solid knowledge of the market for forex.

Trading Experience - Automated trade strategies rely heavily on the algorithmic use of mathematical models to generate trades. Advanced traders who are familiar with market trends and behavior can make better decisions regarding the application of these strategies.

Risk Management- Automated trading techniques could be developed to incorporate sophisticated risk management strategies including position sizing as well as stop-loss order. Advanced traders, who have an grasp of these concepts are better equipped to apply these strategies efficiently and minimize the risk of significant losses.

Customization - Automated trading strategies can be customized to meet the trader's specific goals and needs. Advanced traders, who have an knowledge of their style of trading and risk tolerance, can more effectively design and tailor automated trading strategies to meet their requirements.

Forex automated trading is better suitable for traders with advanced levels due to their experience in trading and technical expertise. It is crucial to realize that automated trading is not always a sure way to be successful. Before making use of any automated trading strategy in live trading, traders at all levels need to be sure to test it thoroughly. Follow the most popular best crypto trading bot for blog tips including stop loss in trading, crypto strategies, cryptocurrency automated trading, trading divergences, best automated crypto trading bot, online trading platform, trading with indicators, algo trading strategies, best crypto trading bot 2023, crypto futures trading and more.

How To Apply An Forex Hedging Strategy

A forex hedge strategy can be used to manage risks and shield investments or trading in the forex market from price fluctuation. Here is a step-by step guide on how to use an approach to hedge against forex. Identifying the risk- The first step in using an forex strategy to protect against a particular risk is to pinpoint the risk. This could be a risk related to an exchange rate or market segment or a geopolitical issue.

Choose a hedging option - There are many options available in the form of forward contracts and currency switches. You should select the hedging instrument that best suits your needs and goals.

Choose the best hedge ratio. It is the ratio of the amount of your hedging position to the size of the original trade/investment. The appropriate hedge ratio will be determined by your risk tolerance market conditions, your personal risks, and the risks you intend to hedge against.

Apply the hedging strategy After you have identified the ideal hedge ratio you can start implementing your forex hedging strategy opening the position to hedge. This is typically a trade that you execute in the reverse direction of the current position using an amount equal to or greater than the hedge ratio.

Monitor the hedging positions - You must monitor its performance and make any adjustments needed to ensure that the current position continues to be hedged efficiently.

Forex hedging strategies can be beneficial tools to manage the risk of trading in forex. To hedge against specific risk, you must be aware of them, select the best hedging tool and keep track of how your investment is performing. It is important to be aware of the risks and costs of hedging before you start to implement one.